Don’t rely on the bank valuing your loyalty

A common issue we often encounter is when clients buying a property have an offer accepted but have just hung their hat on their own bank approving the loan, only...

Read more

Tougher scrutiny of borrower’s spending on the horizon

Last week I attended an Australian industry broker conference in Sydney. It was interesting to see the level of change happening in the lending environment over there where approx 55-60%...

Read more

LVR restrictions may become permanent

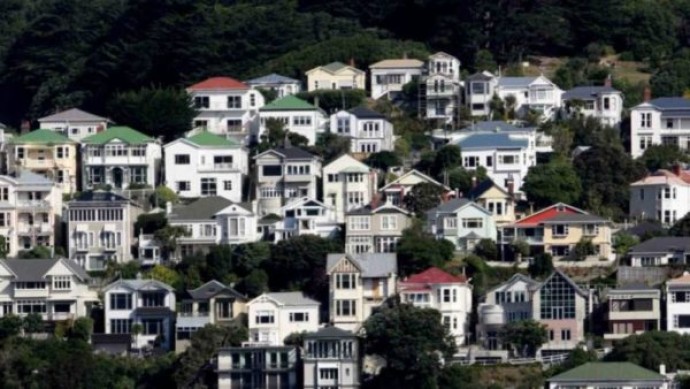

permanent tool going forward. The recent uptake in first home buyers being a large part of the market (especially in Wellington) has lead to the Reserve Bank potentially looking at...

Read more

Interest Rate Update

Major banks short-term rates have been quite low recently and it can be easy to get swayed by what appears to be cheap rates e.g. 4.35% 1-year specials.

Read more

Improve your home loan approval chances with these tips

1. Watch your bank statements! Close any accounts you hardly use and make sure you don’t go into unauthorised overdraft.

Read more

Changes in lending policy for 2018

As we lead into Xmas there are some changes in the lending world to be wary of for January 2018.

Read more

Lending restrictions set to ease early 2018

The Reserve Bank has today announced a ‘modest’ easing of Loan to Value Ratio (LVR) restrictions from early 2018.

Read more

How to avoid finance falling over on your property deal

There has been some interesting articles this week relating to property deals (it appears mainly attributed to Auckland) falling over at the last minute due to finance.

Read more

OCR held at 1.75% for fifth time

The OCR (Official Cash Rate) remains unchanged again, at 1.75%, for the fifth consecutive review.

Read more

What is a revolving credit?

As part of numerous measures to curb access to credit, the banks have started to restrict the availability of revolving credits—mainly around the size of accessible limits, and linked to...

Read more